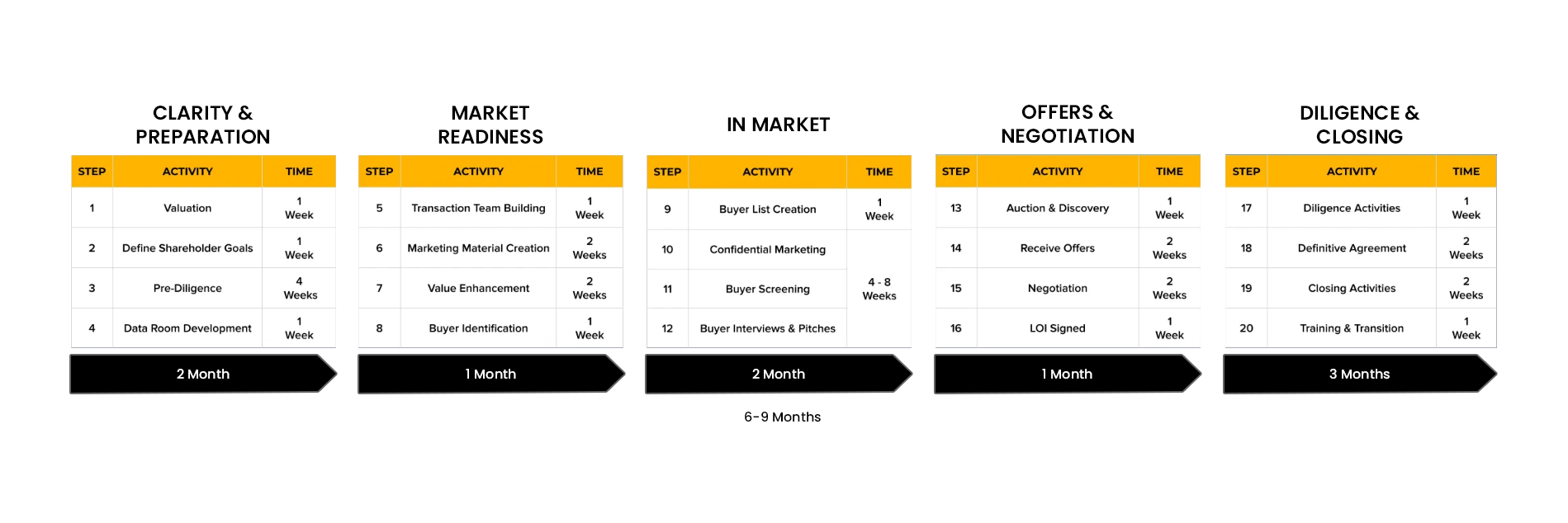

For selling a business most qualified/financially able buyer(s) are selected. Buyers that are interested in purchasing the business request a meeting with the seller and typically like to visit the business location. These meetings/visits are usually done after hours or during the weekends to avoid any premature disclosures of a business sale to employees and customers.

In most sales this is the first time a potential buyer will be looking at the facility and meeting the seller. As part of selling a business, we as the business brokers schedule all the appointments and meeting, and we are usually present at the meeting as a mediator. During and after the meeting, buyers may have additional questions regarding the business and operations which will be handled by us, and this can continue for weeks and months based on the complexity and type of business. After all the questions are answered the buyer can make an offer. Appropriate negotiation is very crucial for selling a business and to get the best possible price and terms, that is where we thrive, we have the expertise and right negotiation techniques. It is all about finding the right balance between the buyer and seller, so it is a win-win situation for both parties.